Cryptocurrency has revolutionized the financial landscape, offering innovative ways to manage digital assets. Coinbase, a leading platform in this digital renaissance, provides seamless integration with traditional bank accounts. Understanding the timeframe for Coinbase bank account transactions is crucial for efficient digital asset management.

Exploring the Coinbase Interface: A Gateway to Digital Finance

Coinbase’s interface stands as a beacon of user-friendliness in the complex world of cryptocurrency transactions. Designed with an intuitive approach, it allows even novices to navigate the world of digital finance with ease. Key features include:

- Dashboard Overview: A comprehensive view of your portfolio, displaying real-time asset values;

- Bank Account Linking: Simple steps to connect your bank account securely;

- Instant Buy/Sell: Quick transaction capabilities for major cryptocurrencies;

- Recurring Transactions: Set up automatic buys or sells on a schedule;

- Security Features: Robust security measures to protect your digital assets.

This well-structured interface is crucial for enabling users to link their bank accounts seamlessly, thus opening the door to efficient cryptocurrency transactions.

The Time Dynamics of Bank Transactions on Coinbase

The transaction times on Coinbase, especially regarding bank account deposits and withdrawals, can vary. Generally, these transactions take about 3-5 business days. However, this timeframe is not static and can be influenced by several factors:

- Day of the Week: Transactions initiated during the weekend or holidays may experience delays;

- Transaction Volume: High volumes can extend processing times;

- First-Time Transactions: Initial transactions may undergo additional scrutiny, slightly delaying the process.

Understanding these dynamics helps users plan their transactions more effectively.

Factors Influencing Transaction Speed

Several elements play a pivotal role in the speed of Coinbase bank account transactions. These include:

- Bank Policies: Banks have distinct processing times and regulations that can impact transaction speed;

- Verification Processes: Coinbase’s commitment to security means enhanced verification steps that may extend the time for a transaction;

- Network Traffic: The blockchain network can experience high volumes of transactions, leading to potential delays.

Enhancing Transaction Speed: Tips and Tricks

To expedite transactions on Coinbase, users can adopt several strategies:

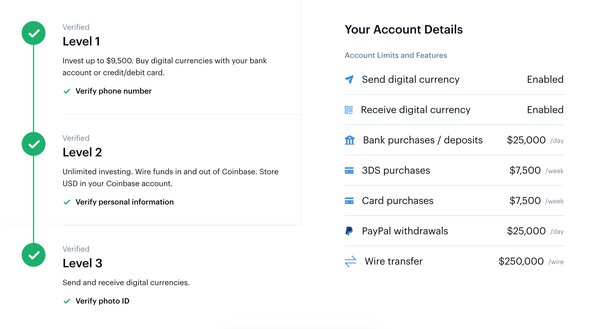

- Complete Account Verification: Ensure all required verification steps are completed;

- Opt for Faster Payment Methods: Select quicker payment options if available;

- Transact During Off-Peak Hours: Avoid times of high network traffic.

These tips can significantly reduce waiting times for transactions.

Comparing Coinbase with Other Platforms

A comparative analysis with other platforms highlights Coinbase’s strengths:

| Feature | Coinbase | Platform B | Platform C |

|---|---|---|---|

| User Experience | Excellent | Good | Average |

| Transaction Speed | Fast | Moderate | Slow |

| Security | High | Moderate | Low |

| Customer Support | Strong | Weak | Moderate |

This table underscores Coinbase’s superior performance in key areas like transaction speed and user experience.

Real-Life User Experiences with Coinbase Bank Account Integration

The landscape of user experiences with Coinbase’s bank account integration paints a generally positive picture, marked by a blend of efficiency and reliability. Numerous testimonials from a diverse array of users consistently highlight the platform’s swift transaction process.

These stories, ranging from first-time users to seasoned cryptocurrency traders, often emphasize the ease and speed with which they can transfer funds from their bank accounts to Coinbase and vice versa. Many have praised the platform for its straightforward approach to handling complex digital transactions, which has been a significant factor in building its reputation as a trusted name in the cryptocurrency space.

This trust is further cemented by the fact that these experiences come from a wide spectrum of users, each with different levels of expertise and expectations, yet finding common ground in the platform’s effectiveness.

Navigating Potential Hiccups in Coinbase Transactions

Despite the generally smooth experience, Coinbase users, like those on any digital platform, may occasionally face certain challenges. One common issue is transactions remaining in a ‘pending’ state for a longer duration than anticipated. This can happen due to various reasons such as network congestion or additional security checks, especially for large transactions. Another potential hiccup, particularly for new users, is the delay in account verification.

As Coinbase places a strong emphasis on security and compliance, the verification process is thorough, which can sometimes lead to longer wait times for account activation. However, it is important to note that these issues are not unique to Coinbase and are fairly common in the world of digital finance.

By understanding and anticipating these potential delays, users can better plan their transactions and mitigate any inconvenience. Furthermore, Coinbase’s customer support is often highlighted for its responsiveness in assisting users through these challenges, thereby ensuring a satisfactory resolution in most cases.

The Future of Coinbase and Bank Transactions

Looking ahead, Coinbase is clearly focused on evolving and enhancing its bank transaction capabilities. A key area of this evolution is the implementation of faster blockchain technologies. As the blockchain landscape continues to grow and innovate, Coinbase is actively exploring and integrating newer solutions that promise to process transactions more rapidly. This includes not only speeding up the transactions themselves but also ensuring that these advancements are compatible with existing banking infrastructures. In addition to technological upgrades, Coinbase is committed to continuously refining its user interface.

This ongoing effort aims to make the platform even more intuitive and accessible, catering to the needs of both novice users and experienced traders. Furthermore, the platform is doubling down on its security protocols. In an era where digital security is paramount, Coinbase is at the forefront of implementing advanced security measures. These measures are designed not just to safeguard user assets and information but also to streamline transactions, thereby striking a balance between security and efficiency.

As these enhancements come to fruition, they are expected to significantly reduce processing times and elevate the overall user experience, reaffirming Coinbase’s position as a leader in the integration of digital and traditional banking.

Coinbase and USDT ERC20 Integration: Enhancing Bank Account Transactions

Coinbase’s support for USDT (Tether) on the Ethereum network, known as ERC20 tokens, significantly enhances its bank account integration. This feature allows users to seamlessly transact with USDT ERC20, a stablecoin pegged to the US dollar, thereby providing stability and reducing the volatility often associated with cryptocurrencies.

The integration of USDT ERC20 on Coinbase offers:

- Easy conversion between USDT and traditional currencies via linked bank accounts, improving liquidity;

- Smooth transactions within the Ethereum network, beneficial for users involved in decentralized finance;

- A blend of stability and flexibility, combining the predictability of a fiat-pegged cryptocurrency with the versatility of the Ethereum blockchain.

This compatibility aligns with Coinbase’s goal of providing a comprehensive, user-friendly platform that bridges traditional banking with the dynamic world of digital finance.

Conclusion

Coinbase’s integration with bank accounts is a testament to the evolving synergy between traditional and digital finance. Understanding the nuances of transaction times is key to leveraging this powerful platform for effective cryptocurrency management.