In the digital age, one term that has become increasingly prevalent is “cryptocurrency.” This revolutionary form of currency, which began with the creation of Bitcoin in 2009, has not only challenged our traditional notions of money but has also opened doors to a myriad of technological innovations. In this guide, we will delve into the intricacies of how cryptocurrency works, exploring its fundamental concepts, operations, and its potential impact on our financial future.

Understanding the Basics of Cryptocurrency

Cryptocurrency represents a paradigm shift in how we think about money. As a digital or virtual currency, it employs advanced cryptography for securing transactions and controlling the creation of new units. This cryptographic foundation is a stark contrast to the physical nature of traditional fiat currencies like dollars or euros, which are regulated by governments and central banks.

The underlying technology of cryptocurrency, the blockchain, is essentially a digital ledger that is distributed across a network of computers. Each transaction made with a cryptocurrency is recorded in a block, and each block is linked to the one before and after it, creating a secure and transparent transaction history. This decentralized nature of the blockchain means that no single entity, be it a government or financial institution, has control over the currency. This decentralization is not just a technical feature but also a philosophical one, reflecting a move towards a more democratized financial system. The immunity of cryptocurrencies to traditional governmental control and interference has its roots in this decentralized approach. It allows for a financial system where transactions are transparent and parties have more control over their own money. This is especially significant in countries with unstable currencies or where the government exerts significant control over the financial sector.

In essence, cryptocurrencies and their underlying blockchain technology represent a rethinking of financial systems, prioritizing transparency, security, and decentralization. This revolutionary approach challenges the traditional, centralized systems and paves the way for a more inclusive global financial landscape.

Key Components

- Blockchain Technology: The backbone of cryptocurrency is blockchain technology. Imagine it as a digital ledger that is duplicated across a network of computers. Whenever a new transaction occurs, a record of that transaction is added to every participant’s ledger. It’s this technology that ensures security and transparency in the transaction process;

- Decentralization: Unlike centralized banking systems, where transactions are controlled and verified by a central authority, cryptocurrencies are typically decentralized and rely on technology and consensus among participants to ensure validity;

- Digital Wallets: To use cryptocurrencies, you need a digital wallet. It’s a software program that stores your private and public keys, interacts with various blockchains, and enables users to send and receive digital currency and monitor their balance.

How Cryptocurrencies Operate

Blockchain Technology

At its core, a blockchain is a series of interconnected blocks, each containing a list of transaction records. The technology is hailed for its ability to maintain transparency and resist alteration of data, making it a robust platform for transactions.

Mining

Cryptocurrency mining is the process by which transactions are verified and added to the blockchain ledger. It involves solving complex cryptographic puzzles to create a new block, which is then added to the blockchain. This process rewards miners with a certain amount of cryptocurrency, incentivizing them to maintain the network’s integrity.

Transactions

Making transactions with cryptocurrency is a process of sending and receiving digital currency between wallet addresses. These transactions are secured through the use of public and private keys, with the public key serving as an address to receive funds, and the private key as a means to sign and authorize transactions.

Popular Cryptocurrencies

While Bitcoin might be the most well-known cryptocurrency, the digital currency landscape is vast and varied.

- Bitcoin: Launched in 2009 by an unknown person or group of people using the name Satoshi Nakamoto, Bitcoin is the original cryptocurrency. It’s known for its scarcity, with a cap of 21 million coins, and its pioneering use of blockchain technology;

- Ethereum: This is not just a cryptocurrency but also a platform for building decentralized applications (dApps). Ethereum’s token, Ether, is used to power these applications;

- Others: There are thousands of cryptocurrencies, including Ripple (XRP), Litecoin (LTC), and Cardano (ADA), each with its unique features and uses. Some, like Ripple, are designed for speed and efficiency in financial transactions, while others like Cardano focus on sustainability and scalability.

The Role of Decentralization

Decentralization is a cornerstone of the cryptocurrency movement. By distributing the control and maintenance of the network across various locations, it reduces the risk of central failure and censorship. This model contrasts with traditional financial systems, where central banks or government bodies have control over currency.

Benefits and Challenges

Benefits

- Security. Cryptocurrencies offer enhanced security features that are fundamentally different from traditional banking systems. This security is primarily achieved through the use of cryptography. Each transaction is secured with a cryptographic code, which ensures that the sender and receiver of the cryptocurrencies are the only parties involved in the transaction. This system significantly reduces the risk of fraud and counterfeiting. Furthermore, the decentralized nature of blockchain technology means that there is no single point of failure, making it extremely difficult for hackers to compromise the entire network. This robust security protocol has been a key factor in the growing trust and adoption of cryptocurrencies;

- Investment Potential. The investment landscape has been significantly altered by the emergence of cryptocurrencies. They represent a new asset class that has attracted a diverse range of investors, from individuals to large institutional investors. The potential for high returns, albeit with corresponding high risk, is a hallmark of cryptocurrency investments. The growth of Bitcoin, which saw remarkable increases in value over a relatively short period, has been particularly notable. However, it’s important for potential investors to understand the market’s volatility and to approach cryptocurrency investments with a strategy that considers both the opportunities and the risks involved;

- Global Transactions. One of the most revolutionary aspects of cryptocurrencies is their ability to facilitate global transactions. Traditional international transactions can be costly and slow, often requiring currency exchanges and involving multiple intermediaries. Cryptocurrencies, by contrast, enable direct transactions between parties, regardless of their geographical location, with significantly lower transaction fees and faster processing times. This global reach not only makes cryptocurrencies an efficient choice for personal and business transactions but also opens up financial services to regions and populations that have historically been underserved by the traditional banking system.

Challenges

- Volatility: Cryptocurrencies can be extremely volatile, with prices fluctuating wildly;

- Regulatory Uncertainty: The legal status of cryptocurrencies varies across countries, with some governments embracing them, while others have banned or restricted them;

- Scalability: As the number of transactions grows, many cryptocurrencies struggle to scale up efficiently while maintaining security and decentralization.

How to Get Started with Cryptocurrencies

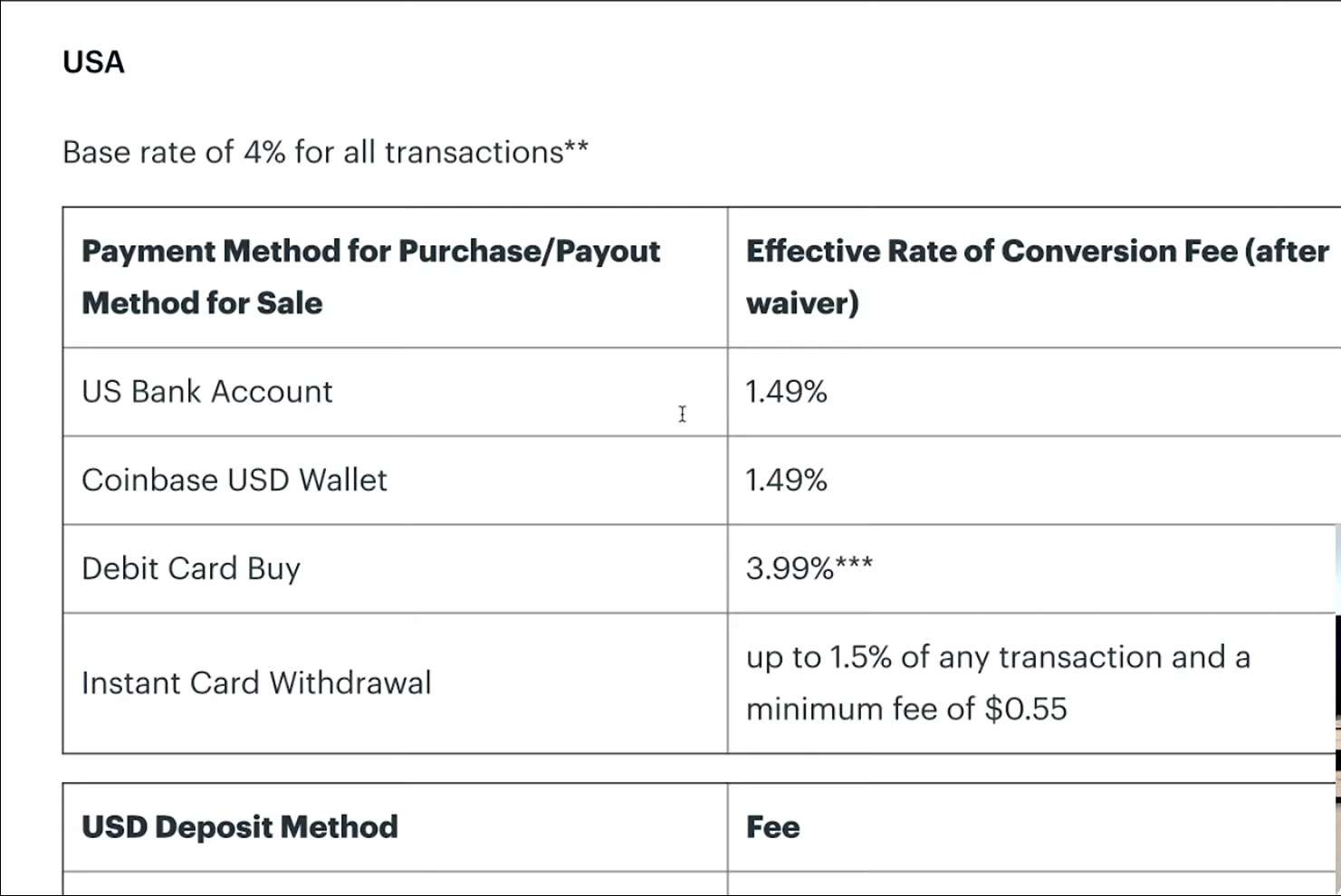

- Buying Cryptocurrency. The first step to getting started is buying some cryptocurrency. This can typically be done on a cryptocurrency exchange, where you can exchange fiat money (like USD, EUR) for a choice of various cryptocurrencies;

- Storing Cryptocurrency. Once you own cryptocurrency, you need to store it securely. This is where digital wallets come in. There are several types of wallets – from online wallets, which are convenient, to hardware wallets, which offer higher security;

- Using Cryptocurrency. Cryptocurrencies can be used for a range of purposes, from purchasing goods and services to an investment or trading asset. The use cases are expanding as the technology becomes more integrated into different sectors.

The Future of Cryptocurrency

Cryptocurrencies are more than just an alternative form of currency; they represent a new technological paradigm. From the development of decentralized finance (DeFi) that aims to recreate traditional financial systems without intermediaries, to the emergence of NFTs (Non-Fungible Tokens) changing the way we think about ownership in the digital world, the potential is vast.

Conclusion

Cryptocurrency is an exciting and evolving field. While it offers potential for innovation and a new form of financial freedom, it also comes with challenges and risks. As with any emerging technology, it’s important to approach cryptocurrency with a balanced perspective, acknowledging both its possibilities and its limitations.

For those interested in diving deeper into the world of cryptocurrency, numerous resources are available. Online forums, educational websites, and thought leaders in the space can provide further insights and up-to-date information.