Cryptocurrency, including Bitcoin, Ethereum, and a host of altcoins, has taken the financial world by storm. This digital revolution has captured the imagination of today’s youth, offering an exciting departure from traditional financial norms. While older generations favor the stock market, teenagers perceive it as ‘old school.’ They crave futuristic investments aligning with their digital lifestyle. Moreover, modern teenagers embrace cashless living with Apple Pay and Venmo, making digital currencies a natural fit.

In this comprehensive guide, we will take you on a journey through the world of cryptocurrency investing. We will explore the basics of cryptocurrencies, demystify the blockchain, delve into major cryptocurrencies like Bitcoin and Ethereum, provide step-by-step guidance on how to initiate crypto investments, and discuss the risks and rewards involved. We’ll also address the crucial aspect of investing as a minor, where adults must create custodial accounts to buy assets on your behalf.

What is Cryptocurrency?

At its core, cryptocurrency is a digital representation of value used to buy and sell goods and services and can also be used as an investment. Unlike centralized currencies like the US dollar, cryptocurrencies have the potential to appreciate dramatically, depending on the market. Like any other currency, the value of cryptocurrencies regularly fluctuates. While cryptocurrencies can be used for transactions in some cases, they do not yet have legal tender status in the United States. Although some websites may accept them as a payment option, the federal government does not officially recognize cryptocurrency as a valid or acceptable form of monetary value. For instance, if you owe taxes to the IRS, you cannot use cryptocurrency to pay your debt.

However, the global landscape is evolving rapidly. Several nations, such as El Salvador and the Central African Republic, have already voted to accept cryptocurrencies as a form of legal tender. Nevertheless, Americans can still purchase and hold cryptocurrencies through the blockchain, allowing teenagers and adults alike to invest in this growing market.

How Do Cryptocurrencies Work and What is the Blockchain?

The concept of digital currency may seem confusing at first, but the underlying technology is surprisingly simple. Cryptocurrencies operate on a decentralized network of computers known as a blockchain, which keeps track of all transactions made using the currency. Think of the blockchain as a digital ledger that records every transaction. Unlike a traditional bank, there is no central authority overseeing the blockchain. Instead, it is maintained by a network of blocks containing information. This decentralized nature makes the blockchain extremely secure.

To tamper with the recorded transactions on the blockchain, one would have to alter all the records in the distributed computers simultaneously, an almost impossible task. This high level of security is one of the reasons why cryptocurrencies are gaining popularity. Blockchain technology itself dates back to 1991, but it wasn’t until 2009 that Satoshi Nakamoto put it into action to create the first cryptocurrency—Bitcoin. Individuals who “mined” data through the blockchain were rewarded with a small amount of the currency, with the understanding that the total amount was limited to only 21 million bitcoins. As of September 2022, approximately 19.14 million bitcoins have been mined.

Bitcoin – A Simple Explanation for Teens (and Kids)

Bitcoin, created in 2009 by Satoshi Nakamoto, follows the principles outlined in a whitepaper by this mysterious and pseudonymous figure. Nakamoto envisioned “a purely peer-to-peer version of electronic cash” that would enable online payments to move directly between parties, bypassing financial institutions.

Unlike traditional currency, Bitcoin doesn’t exist in physical form. Instead, balances are stored in a public ledger within the Bitcoin blockchain, accessible for anyone to verify. Despite not being considered legal tender in the US, Bitcoin reigns as the most popular cryptocurrency, paving the way for numerous altcoins. Since its inception, Bitcoin has experienced significant growth. In November 2021, a single Bitcoin’s value soared to over $68,000, setting new records. This extraordinary success has contributed to the proliferation of cryptocurrencies and the ever-growing interest of young investors.

Ethereum and the World of Altcoins

Ethereum, introduced by Vitalik Buterin in 2015, stands as one of the most prominent altcoins. Unlike Bitcoin, Ethereum serves as more than just a digital currency; it’s a decentralized platform for building and running smart contracts and decentralized applications (dApps). This versatility has earned Ethereum a special place in the crypto ecosystem.

Beyond Bitcoin and Ethereum, a multitude of altcoins have emerged, each with its unique features and purposes. Some seek to enhance privacy, others prioritize scalability, and many explore novel use cases. As a young investor, exploring the diverse world of altcoins can be both exciting and potentially rewarding. However, it’s crucial to conduct thorough research and understand the specific features, use cases, and risks associated with each altcoin before investing. The crypto market is highly volatile, and not all altcoins will achieve long-term success.

How to Get Started Investing in Cryptocurrencies

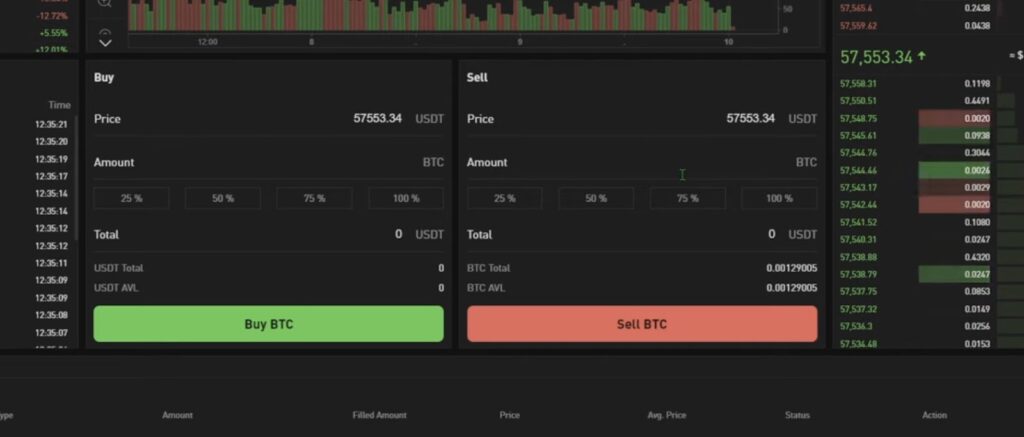

Now that you’ve gained an understanding of cryptocurrency basics, the blockchain, and major cryptocurrencies like Bitcoin and Ethereum, it’s time to explore how to start your crypto investment journey. While investing in cryptocurrencies as a teenager comes with its unique challenges, it’s entirely possible with the support of responsible adults.

- Establish a Custodial Account: As a minor, you cannot purchase financial assets on your own. Typically, your parents or guardians will need to create custodial accounts for you. These accounts allow them to manage the purchasing of assets on your behalf, ensuring compliance with legal requirements;

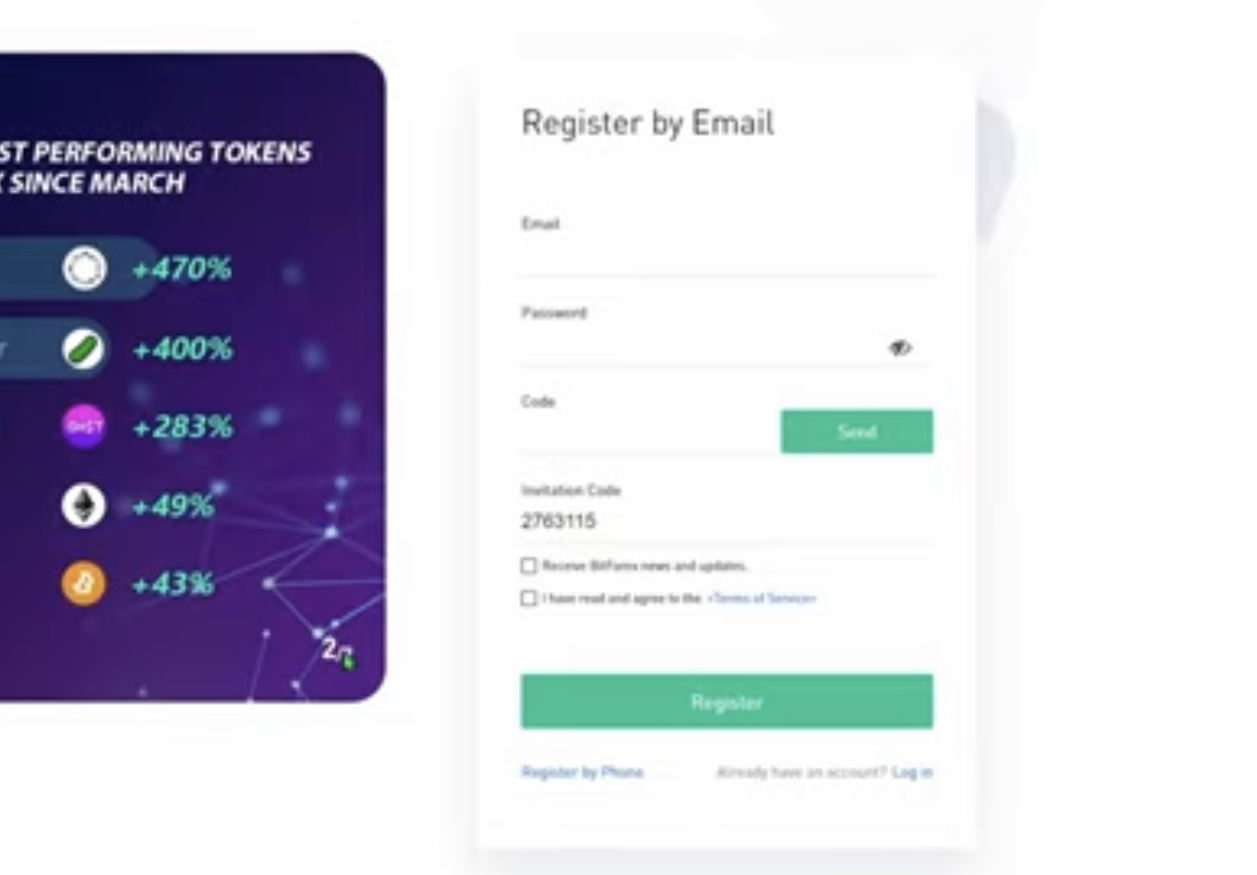

- Choose a Reputable Exchange: Select a cryptocurrency exchange that offers a user-friendly interface, robust security measures, and a wide range of supported cryptocurrencies. Popular options include Coinbase, Binance, and Kraken;

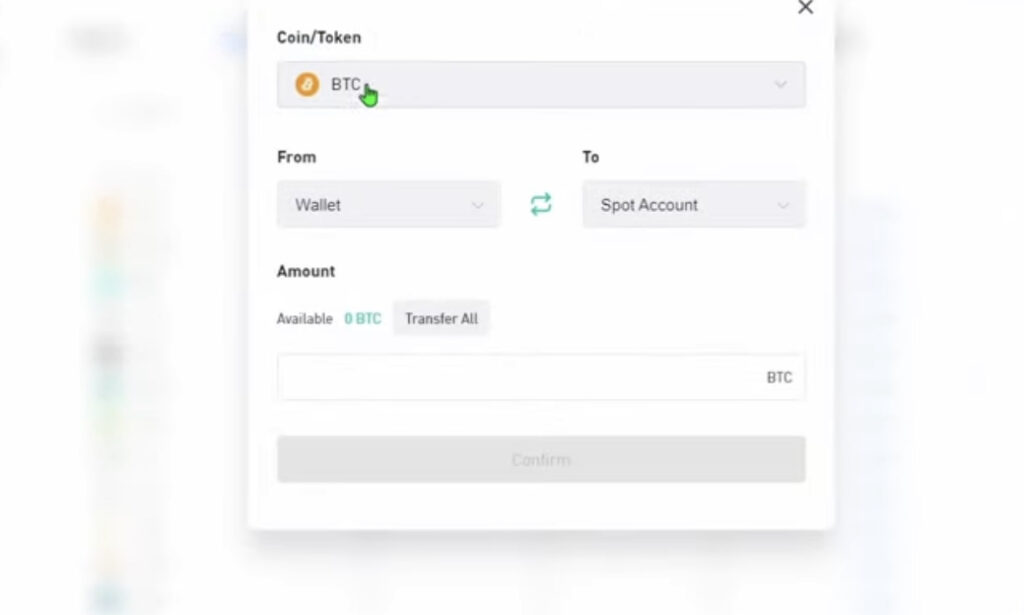

- Secure Your Investments: Learn about cryptocurrency wallets, which are essential for securely storing your digital assets. Hardware wallets offer the highest level of security, but software wallets and mobile apps can also be suitable for smaller amounts;

- Research and Diversify: Conduct thorough research on the cryptocurrencies you plan to invest in. Diversify your portfolio to spread risk. Avoid investing solely in one asset, as the crypto market is known for its volatility;

- Stay Informed: Keep up with cryptocurrency news and market trends. Understanding the factors that influence crypto prices will help you make informed investment decisions.

Risks and Benefits of Investing in Cryptocurrencies

As with any investment, there are both risks and benefits associated with investing in cryptocurrencies. It’s essential to weigh these factors carefully before diving into the crypto market.

Benefits:

- Potential for High Returns: Cryptocurrencies have shown the potential for significant price appreciation, offering the chance for substantial profits;

- Decentralization: Cryptocurrencies operate on decentralized networks, reducing the influence of central authorities like banks and governments;

- Accessibility: Cryptocurrency investments are accessible to a global audience, allowing young investors to participate in the digital economy.

Risks:

- Volatility: Cryptocurrencies are notorious for their price volatility, which can result in significant losses if not managed properly;

- Lack of Regulation: The lack of regulatory oversight can make the crypto market susceptible to fraud and scams;

- Security Risks: Cryptocurrency wallets and exchanges can be vulnerable to hacking and theft, emphasizing the need for robust security measures.

In the ever-evolving world of finance, cryptocurrency presents an exciting opportunity for young investors to explore new horizons. With the right knowledge, guidance, and responsible decision-making, teenagers can participate in the growing crypto market while minimizing risks. Remember that investing always carries inherent risks, and it’s essential to start small, stay informed, and never invest more than you can afford to lose. As the world of cryptocurrencies continues to evolve, the possibilities for young investors are limitless, and the future looks promising for those willing to embrace this digital revolution.

Ethereum and the Blockchain

As our journey into the world of cryptocurrency continues, let’s shift our focus to Ethereum—a programmable blockchain that empowers developers to create and deploy decentralized applications (dApps). These dApps, or decentralized applications, are open-source software that operate without a central authority’s control.

Ethereum introduces the concept of smart contracts, which are written in various programming languages and serve as self-executing agreements. The terms of these agreements between buyer and seller are directly encoded into lines of code. This innovative approach enables trustless transactions, reducing the need for intermediaries. Ethereum also boasts its own cryptocurrency token, known as “Ether” (ETH). Ether facilitates transactions within the Ethereum network and serves as a reward for participants who perform computational work. Today, Ether stands as the second most valuable and widely recognized cryptocurrency, following Bitcoin’s lead.

Crypto Wallets – Hot and Cold

Having explored the blockchain and Ethereum, let’s now delve into the world of cryptocurrency wallets. These digital wallets securely store your public and private keys, allowing you to interact with various blockchains, view your balance, and perform transactions.

Two primary types of wallets exist:

- Hot Wallets: These online wallets are connected to the internet, offering convenience but also vulnerability to potential hacks. A popular example is the wallet associated with the Coinbase exchange, enabling users to buy, sell, and store cryptocurrencies;

- Cold Wallets: In contrast, cold wallets remain offline and disconnected from the internet, prioritizing security over convenience. The Ledger Nano S, a hardware wallet, is a well-known cold wallet option that stores private keys offline. Some individuals opt for the old-fashioned method of noting down their private and public keys on paper for added security.

Regardless of your choice, the blockchain’s inherent security makes it a challenging target for hackers. Cryptocurrencies have, for the most part, remained secure against cyberattacks, with only rare instances of government-backed attacks posing a threat.

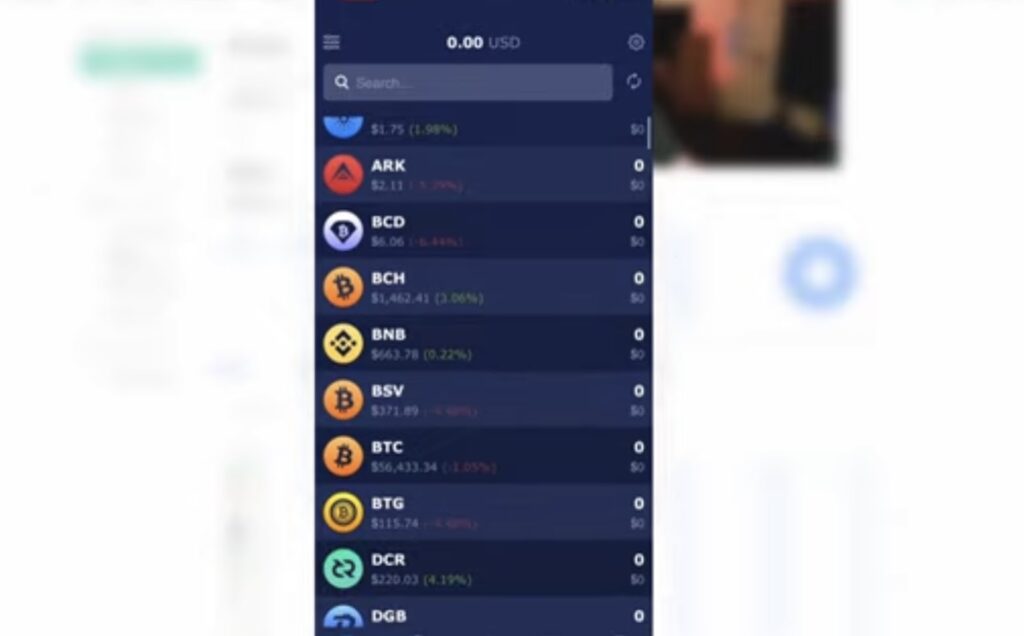

Varieties of Cryptocurrencies

While Bitcoin and Ethereum stand as prominent figures in the cryptocurrency landscape, a plethora of smaller, lesser-known options are available through exchanges worldwide. Websites like Coinmarketcap.com rank these cryptocurrencies by market value, calculated as the coin’s value multiplied by the number of coins in circulation.

Here’s a list of some of the largest and most popular cryptocurrencies, each with its unique features and purposes:

- Bitcoin (BTC-USD): Originating in 2009, Bitcoin reigns as the world’s most valuable cryptocurrency;

- Ether (ETH-USD): Launched in 2015, Ether is the cryptocurrency powering the Ethereum blockchain;

- Tether (USDT-USD): Tether is a stablecoin, pegged to the US dollar and offering stability;

- Binance Coin (BNB-USD): Binance Coin, introduced in 2017, has witnessed significant growth;

- Cardano (ADA-USD): Designed for government and financial institution use, Cardano boasts a market cap exceeding $15 billion;

- Dogecoin (DOGE-USD): Initially created as a joke, Dogecoin’s market cap now surpasses $8.4 billion.

Although countless altcoins exist, novice teen investors may opt to stick with the top three cryptocurrencies for safety when entering the crypto market.

The Risks of Investing in Cryptocurrency

Cryptocurrency investments, much like traditional investments, come with their share of risks. Young investors, in particular, should exercise caution, given the crypto market’s notorious volatility. For instance, Bitcoin, while widely recognized, experienced a significant decline. After reaching a high of $68,000 in November 2021, its value plummeted to around $20,000 in September 2022—a staggering 70% loss.

Furthermore, some well-known crypto platforms and investors, such as Voyager Digital, Celsius, and Three-Arrows Capital, faced bankruptcy, leaving customers without access to their deposits. This highlights the importance of cold wallets for added security. While crypto investments offer excitement, they also entail a degree of risk. It’s essential to approach them with caution and refrain from investing more than one can afford to lose.

How Much Teens Should Invest in Crypto

Teen investors often have limited funds at their disposal, making it important to consider their current savings. A conservative approach might involve investing a small fraction of Bitcoin or Ethereum, typically ranging from $300 to $500, if available.

Who Accepts Cryptocurrency as a Payment Option

While the US government doesn’t recognize cryptocurrency as legal tender, numerous online and brick-and-mortar businesses do. For example, Overstock.com started accepting Bitcoin as a payment method in 2021. Other major companies like Microsoft, Home Depot, Virgin Airlines, and Whole Foods have also embraced cryptocurrency payments. Although the acceptance of cryptocurrency is growing, it remains relatively limited compared to traditional forms of payment.

How to Buy and Sell Crypto Through a Cryptocurrency Exchange

Investing directly in cryptocurrency often involves using a cryptocurrency exchange, acting as an intermediary between buyers and sellers. Popular exchanges like Coinbase, Binance, and Kraken offer a wide range of cryptocurrencies for trading. However, these exchanges typically do not accept members under the age of 18, and they do not offer custodial accounts. Parents can play a pivotal role by purchasing crypto on behalf of their children. Detailed information on the top crypto exchanges can be found on Coinmarketcap.com.

Custodial Accounts Necessary for Teen Investors Under 18

In the United States, minors under 18 can only invest through custodial accounts, whether in stocks, mutual funds, or cryptocurrencies. These accounts are managed by an adult custodian, usually a parent or guardian, while the assets technically belong to the child.

Upon reaching the age of majority, typically 18 or 21, the minor gains control of the account and its assets. Opening a custodial account involves providing essential information, including names, addresses, Social Security numbers, and government-issued IDs.

How Teens Can Invest in Crypto Through Special Custodial Accounts

Another avenue for young investors to access cryptocurrency is through online brokers that facilitate custodial accounts tailored for minors. Parents, as custodians, can establish these accounts on behalf of their children, who will gain full control once they reach the age of majority.

Companies like Flyte, EarlyBird, Stack, and Onu offer platforms where parents can create custodial accounts, making it easier for teens to learn about investing and eventually manage their assets. These accounts bridge the gap between youth and cryptocurrency investment, ensuring a seamless transition to full ownership when the time comes.

Cryptocurrency presents both opportunities and challenges for young investors. By understanding the nuances of this dynamic market, exercising caution, and seeking responsible guidance, teenagers can embark on a journey that may shape their financial future.

The Vulnerability of Crypto Investments

In this chapter, we delve into a critical aspect of cryptocurrency investments: their lack of protection compared to traditional stock investments. It is imperative to grasp the regulatory disparities between these two financial realms.

Lack of Protection for Crypto Investments

Cryptocurrency investments diverge significantly from traditional stock investments concerning regulatory safeguards. When an individual invests in stocks, they can take comfort in the Securities Investor Protection Corporation (SIPC), which safeguards their investment, offering protection of up to $500,000. However, it’s vital to clarify that this protection does not extend to mitigating losses resulting from poor investment decisions or the acquisition of worthless securities. In the words of the SIPC: “SIPC does not protect against the decline in value of your securities or against losses due to a broker’s bad investment advice.”

Contrastingly, cryptocurrency investments lack such regulatory coverage. Entities like the SIPC or the Federal Deposit Insurance Corporation (FDIC), which insures bank deposits, do not provide protection for cryptocurrency holdings. To safeguard one’s interests, it is crucial to investigate whether the platform chosen for cryptocurrency investment offers any form of protection. For instance, a visit to the Onu website’s FAQ section reveals a clear statement: “For all crypto holdings: Onu offers Crypto investing for your child’s custodial account through Alpaca Crypto LLC… Cryptocurrencies are not stocks and cryptocurrency investments are not protected by either FDIC or SIPC.” This distinction between cryptocurrency and traditional securities investments is a significant consideration for young investors. It underscores the importance of due diligence and understanding the unique risks associated with the crypto market.

Limitations on Transferring Crypto Assets

When teenagers, under parental supervision, purchase cryptocurrency through a custodial brokerage account, they may encounter restrictions on transferring those assets elsewhere. Unfortunately, this crucial piece of information is often not prominently displayed on the websites of these online brokerage firms.

To navigate this potential obstacle, it is advisable to pose specific questions regarding the transfer of cryptocurrency from the platform. Understanding these limitations upfront can aid in making informed investment decisions. In many cases, custodial accounts are designed to provide a secure and controlled environment for managing assets. While this can be advantageous in terms of security and oversight, it may limit the flexibility of moving assets to external wallets or other platforms. Teen investors should weigh the benefits of security and parental supervision against the potential restrictions on asset mobility.

Investing in Crypto-Exposed Exchange-Traded Funds (ETFs)

Teens looking for an indirect method of investing in cryptocurrency can explore Exchange-Traded Funds (ETFs). ETFs are investment vehicles that represent diversified portfolios of company stocks, functioning similarly to mutual funds. However, they can be traded like individual stocks through online brokers.

Certain ETFs, known as crypto-exposed ETFs, indirectly track the crypto market by including stocks of US and international corporations engaged in blockchain-related activities. For instance, an ETF may feature stocks of companies like Coinbase (a leading crypto exchange), Marathon Digital Holdings (a Bitcoin mining company), and PayPal. One notable example is the iShares and Tech ETF (symbol: IBLC), managed by Blackrock.

An article by US News and World Report titled “7 Best Cryptocurrency ETFs to Buy” offers insights into cryptocurrency ETF options. These investments can be made through custodial accounts, with parents or other adults serving as custodians while teens retain ownership.

Investing in Crypto-Related Stocks

For teen investors seeking exposure to the cryptocurrency space without directly investing in digital assets, crypto-related stocks present an alternative avenue. These stocks are associated with companies engaged in blockchain technology or cryptocurrency markets. For instance, Coinbase Global Inc. (stock symbol: COIN), as one of the largest crypto exchanges, is indirectly influenced by crypto market dynamics. An article titled “7 Best Cryptocurrency Stocks to Buy” by US News and World Report provides a list of such crypto-related companies. Investing in crypto-related stocks can be facilitated through custodial accounts, wherein parents or responsible adults act as the custodians while teens benefit as the beneficiaries.

Investing in these stocks allows teenagers to indirectly participate in the cryptocurrency market’s growth while avoiding the risks associated with direct cryptocurrency ownership. By investing in companies related to blockchain technology and digital assets, they can align their portfolios with the potential for crypto market expansion.

The Future of Cryptocurrency

As we approach the conclusion of this journey through cryptocurrency, it is crucial to contemplate its future. Cryptocurrency, though still in its infancy, exhibits immense growth potential. Over the past decade, it has evolved from a niche interest into a thriving industry with a global presence.

Furthermore, the increasing acceptance of cryptocurrency as a valid form of payment by numerous businesses foreshadows its broader adoption. Additionally, the utility of blockchain technology, whether through smart contracts, gaming, or NFTs (Non-Fungible Tokens), is set to expand the cryptocurrency landscape, opening up new avenues for innovation and investment. In the ever-evolving world of cryptocurrency, the future holds promise, offering a myriad of opportunities for those who dare to embrace this digital revolution.

The Growth Trajectory of Cryptocurrency

Cryptocurrency’s growth trajectory has been nothing short of remarkable. From its humble beginnings with the creation of Bitcoin in 2009 by the pseudonymous Satoshi Nakamoto, it has transformed into a global phenomenon. What began as an experiment in digital currency has now become a legitimate and thriving financial ecosystem.

Over the years, Bitcoin, often referred to as digital gold, has reached unprecedented heights in terms of value. It shattered records in November 2021 when a single Bitcoin was valued at over $68,000. While its value experienced fluctuations, this remarkable ascent captured the attention of investors worldwide.

Expanding Use Cases

Cryptocurrency is not just about digital coins; it represents a paradigm shift in finance and technology. Beyond its function as a digital store of value, cryptocurrencies have found applications in various domains.

- Smart Contracts: Ethereum, the second-largest cryptocurrency by market capitalization, introduced the concept of smart contracts. These self-executing contracts have the terms of agreements directly written into lines of code. They enable a wide range of decentralized applications (dApps) to function without intermediaries. This innovation has the potential to revolutionize industries like finance, real estate, and law;

- Gaming: Cryptocurrency has made its way into the gaming industry. Blockchain-based games and NFTs have gained popularity. Non-Fungible Tokens represent ownership of unique digital assets within games. This intersection of gaming and crypto has created new opportunities for both gamers and investors;

- Cross-Border Payments: Cryptocurrencies offer a borderless solution for cross-border transactions. Traditional international transfers can be slow and costly, but cryptocurrencies enable near-instantaneous transfers with lower fees. This use case has the potential to disrupt the remittance industry;

- Financial Inclusion: Cryptocurrencies have the potential to provide financial services to the unbanked and underbanked populations globally. With a smartphone and internet access, individuals can access the world of cryptocurrencies, potentially improving financial inclusion;

- NFTs (Non-Fungible Tokens): NFTs have taken the art and entertainment world by storm. These unique digital assets have been used to represent digital art, collectibles, music, and even virtual real estate. The rise of NFTs has created a new market for digital creators and collectors.

Acceptance by Businesses

One of the key indicators of cryptocurrency’s growing significance is its acceptance by businesses. Several major companies now accept cryptocurrency as a form of payment. This includes online retailers like Overstock.com, which started accepting Bitcoin as early as 2021. Tech giants like Microsoft, Home Depot, and Virgin Airlines have also embraced cryptocurrency payments. Even Whole Foods and a handful of restaurants, bars, and cafes have joined the ranks of businesses willing to transact in digital currencies.

These developments signal a shift in the perception of cryptocurrencies from being a niche interest to a legitimate means of conducting business transactions. As more businesses accept cryptocurrencies, the practicality and utility of digital assets become increasingly evident.

The Future Potential of Blockchain Technology

Beyond the specific cryptocurrencies themselves, the underlying blockchain technology holds immense promise. Blockchain is a decentralized ledger system that records all transactions across a network of computers. It offers unparalleled security and transparency, making it a disruptive force across various industries.

- Smart Contracts: Smart contracts, which run on blockchain networks, have the potential to automate and streamline contractual agreements. They eliminate the need for intermediaries, reducing costs and enhancing security. This technology has applications in legal, financial, and supply chain sectors;

- Supply Chain Management: Blockchain technology can revolutionize supply chain management by providing real-time tracking and transparency. This can help reduce fraud, ensure product authenticity, and enhance efficiency in logistics;

- Voting Systems: Blockchain-based voting systems have the potential to make elections more secure and transparent. Votes can be recorded on an immutable ledger, reducing the risk of fraud and manipulation;

- NFTs and Digital Ownership: NFTs, which rely on blockchain, offer a new way to represent and verify ownership of digital assets. This has implications for the art, entertainment, and gaming industries, where digital ownership is crucial;

- Decentralized Finance (DeFi): DeFi platforms, built on blockchain technology, aim to provide financial services without traditional intermediaries. This includes lending, borrowing, trading, and earning interest on cryptocurrencies;

- Healthcare: Blockchain can improve data security and interoperability in the healthcare sector. Patient records, pharmaceutical supply chains, and medical research can all benefit from blockchain’s capabilities.

These emerging applications of blockchain technology are still in their infancy but hold the potential to reshape various industries. As blockchain matures and gains wider acceptance, it will likely drive further adoption of cryptocurrencies.

Conclusion: The Journey Ahead

The journey through the world of cryptocurrency reveals a dynamic and evolving landscape. Cryptocurrency’s growth from an experimental digital currency to a global financial force is a testament to its resilience and potential. Young investors who embark on this journey must navigate the unique risks and opportunities presented by the crypto market. Understanding the regulatory distinctions, limitations of custodial accounts, and alternative investment avenues like crypto ETFs and crypto-related stocks is crucial.

As businesses increasingly accept cryptocurrency and blockchain technology continues to find new applications, the future of this digital revolution remains promising. It offers a path to financial innovation, inclusivity, and empowerment for those who dare to embrace it. The journey ahead in the world of cryptocurrency is filled with excitement and uncertainty. It is a space where technology, finance, and innovation converge, offering opportunities for young investors to be part of a transformative era in the history of finance. Whether you choose to invest directly in cryptocurrencies, explore related assets, or contribute to the development of blockchain technology, the future is yours to shape.