Embarking on the journey of financial independence at a young age is an empowering endeavor. If you’re a teenager eager to take your first steps into the world of investing, this article is your roadmap to success. We’ll guide you through the essential steps, helping you make informed decisions and lay the foundation for a prosperous financial future. So, let’s explore the exciting world of teenage investing and set you on the path to financial growth and security.

1. Gain Basic Stock Knowledge

Embarking on the journey of stock investment as a fledgling investor or ‘Teenvestor’ necessitates a foundational comprehension of stock market intricacies. The absence of such knowledge harbors the peril of rapidly diminishing any nascent financial contributions dedicated to your fledgling financial reserve. A notable challenge for youthful investors is the scarcity of beginner-friendly resources crafted in a vernacular conducive to their comprehension.

A plethora of complimentary educational tools are readily available for your perusal in the realm of investment learning.

TeenVestor.com

Distinguished as the sole online portal offering a comprehensive suite of educational content free of charge for adolescent investors and their guardians. This platform imparts knowledge about an array of topics including stocks, funds, and economic principles. Peruse our press materials for further insights about our offerings.

Andrei Jikh (Youtube Channel)

This channel serves as a valuable resource for novices in the field, elucidating basic investment and economic concepts. However, it is imperative to exercise caution and refrain from accepting investment advice from this or any other Youtube channel.

TeenBusiness (Youtube Channel)

Unique in its complete dedication to the adolescent investor and budding entrepreneur.

Investor.gov

Operated by the Securities and Exchange Commission (SEC) of the United States, a body overseeing securities in the nation. This site provides educational content specifically tailored for teens, encompassing topics such as stocks, ETFs, and diverse investment types, including cryptocurrency.

Investopedia

A portal with a focus on education, catering to both neophyte and seasoned investors. It boasts an extensive glossary of fundamental investment terminology, each term meticulously defined and supplemented with pertinent articles. Investopedia has long been a reputable source for investment insights.

How the Market Works

Alongside hosting a stock market simulation game, this website features an educational section with various lessons about the stock market.

Wall Street Survivor

Similar to the aforementioned site, this one too offers a stock market simulation game and includes educational content about the stock market in its repertoire.

2. Identify Investments Appropriate for Teens

In the realm of adolescent finance, a diverse spectrum of investment options exists, extending from equities and exchange-traded funds to more secure holdings like treasury bonds. For minors under the age of eighteen, investment endeavors necessitate adult participation — usually a parent — to establish a custodial brokerage account or to sanction investment acquisitions. Insights into how guardians can initiate such custodial accounts to facilitate the procurement of stocks and funds are detailed here: Premier Custodial Brokerage Accounts for Youth.

Initiating Teenagers into Equity Investments

Aspiring to embark on equity investment? Consider aligning your choices with personal passions. Selecting stocks in domains that captivate your interest fosters a deeper engagement in comprehending the intricacies of the stock market. Contemplate these elements when embarking as a novice investor:

- Personal leisure pursuits;

- Enterprises employing your kin;

- Firms featured in financial journals, like the Wall Street Journal;

- Corporations with headquarters in your domicile state;

- Major entities within indexes such as the Dow Jones Industrial Average or our bespoke index, The TeenVestor Index Portfolio, as showcased in this article: Equities for the Young Investor;

- Producers of items favored by peers and classmates.

Regarding firms that manufacture youth-appealing goods, Piper Sandler annually surveys over 7,000 adolescents to uncover their preferred brands, spanning footwear, eateries, snacks, apparel, and myriad other consumer goods and services. While basing stock choices solely on brand familiarity might not be the wisest strategy, the survey’s results offer initial investment inspirations. As your investment acumen matures, delve into fundamental analysis to discern stocks meriting your investment.

Here’s an enumeration of leading brands potentially intriguing to teenage investors:

- Top 3 Footwear Labels: Nike (Nike, Inc.), Converse (Nike, Inc.), Vans (VF Corporation);

- Top 3 Handbag Labels: Coach (Tapestry, Inc.), Michael Kors (Capri Holdings), Kate Spade (Tapestry, Inc.);

- Top 3 Dine-Out Spots: Chipotle (Chipotle Mexican Grill, Inc.), Starbucks (Starbucks Corporation), McDonald’s (McDonald’s Corporation);

- Top 3 Snack Makers: Goldfish (Campbell Soup Company), Lays (PepsiCo, Inc.), Cheez-it (Kellogg Company);

- Top 3 Apparel Brands: Nike (Nike, Inc.), American Eagle (American Eagle Outfitters, Inc.), Lululemon (Lululemon Athletica Inc.);

- Top 3 Payment Solutions: Apple Pay (Apple, Inc.), Cash App (Block, Inc.), PayPal (PayPal Holdings, Inc.).

Exchange-Traded Funds: A Prudent Teenage Investment Choice

For those inclined towards less volatile assets than individual stocks, contemplate index-based exchange-traded funds (ETFs). These instruments encapsulate a diversified portfolio of companies, mirroring stock trading dynamics. They resemble mutual funds, yet are purchasable akin to stocks via online brokerage platforms.

Optimal ETFs for young investors are those tethered to broad market indexes like the Dow Jones Industrial Average, the S&P 500, and the NASDAQ. These indexes aggregate a myriad of substantial stocks, hence the index-based ETFs’ volatility mirrors the underlying stocks’ price fluxes. By acquiring ETFs aligned with indexes like the Dow Jones Industrial Average or the S&P 500, a youthful investor diversifies their portfolio, thereby stabilizing their asset base.

An ETF mirroring the NASDAQ, however, presents a contrast, predominantly reflecting the valuation of technology stocks. Consequently, a NASDAQ-based ETF will principally echo the valuation trends of such stocks.

Key ETF symbols for broad index-based ETFs:

- The Dow ETF: SPDR Dow Jones Industrial Average ETF Trust – symbol: DIA;

- The S&P 500: Vanguard S&P 500 ETF – symbol: VOO;

- The NASDAQ: Invesco QQQ – symbol: QQQ.

U.S. Savings Bonds: A Fortress of Security for Teen Investors

For the utmost security in investments, U.S. savings bonds emerge as a sterling choice. These bonds represent loans to the U.S. government, best viewed as a savings mechanism rather than a growth engine like stocks or ETFs. Two primary types exist: Series E.E. U.S. Savings Bonds (or Series EE Bonds) and Series I Savings Bonds, both offering low-risk interest accrual for up to 30 years. The Series I Bonds possess a distinctive feature: their interest rates adjust periodically in response to inflation rates.

The U.S. Treasury has transitioned from issuing physical bonds to digital registrations via www.treasurydirect.gov. As with other investments, a minor requires a guardian to open a custodial account in their stead.

3. Learn What Companies Do

Initiating your quest for investment insights, it’s paramount to commence with acquiring a company’s annual compendium. This tome serves as a yearly disclosure of corporate intricacies to its shareholders. It typically encompasses a comprehensive state-of-affairs narrative, inclusive of a prologue by the Chief Executive Officer, detailed financial enumerations, a synopsis of operational outcomes, segmentation analysis of the market, forthcoming product initiatives, subsidiary endeavors, and an overview of prospective programs under research and development.

In certain instances, entities might opt for a document known as the “10-K” in lieu of the conventional annual report. Mandated by the U.S. Securities and Exchange Commission for all publicly traded companies, the 10-K is a repository of similar data found in annual reports. Esteemed companies, such as Apple, adopt the 10-K as their annual disclosure.

4. Get & Use Financial Data

In the realm of astute investment, delving into the granular specifics of a corporation’s fiscal prowess, especially when juxtaposed against its industry counterparts, becomes paramount. The labyrinth of financial metrics need not be a solitary quest; numerous digital repositories offer insights into pivotal financial barometers such as Return on Equity, Earnings Per Share, Price-Earnings Ratio, and more – critical gauges of corporate vitality, often demystified in stock market educational courses.

Prominent among these troves of data are platforms like:

Before accessing financial information on any company, you need the stock symbol for that company. You should be aware that stock symbols don’t always correspond with the name of the company or its products. For example, Coach Bags are manufactured by Tapestry, Inc. If you want to invest in Coach, you have to purchase stocks in Tapestry, which trades under the symbol TPR. So it’s important to do a little research about the products you want to invest in.

5. Experiment With Dummy or Mock Portfolios

Embarking on investment ventures can be daunting for young financiers, often known as “Teenvestors.” A practical approach to surmount this initial trepidation is to engage in the construction of simulated, or “dummy,” trading portfolios. There exists a selection of digital platforms that facilitate the creation of such mock investment games. Participants can construct theoretical portfolios utilizing fictitious currency, engaging in friendly competition with peers to ascertain who can amass the most significant hypothetical gains. These platforms meticulously compute and display the daily valuation of these fictitious portfolios, organizing them by user aliases. Notable examples of these simulated trading portal include:

In these digital arenas, Teenvestors can hone their investment strategies without the risk associated with real-world financial commitments, thereby gaining confidence and insight into the mechanics of stock trading.

6. Choose the Right Custodial Brokerage Account for Teens

Adolescents are legally restricted from directly possessing equities, mutual funds, and various financial instruments. The age defining a minor varies by state, typically under 18 or 21 years.

Key Considerations in Establishing Custodial Brokerage Accounts for Minors

Minors seeking to venture into investments require the guidance and oversight of a parent or guardian through a custodial brokerage account. This necessitates a guardian’s involvement in registering for such an account via an online brokerage. While the assets in this account are technically under the minor’s name, the guardian assumes control over these investments, ideally collaborating with the young investor, until they reach majority age. Essential factors in selecting an online trading platform encompass:

- Prioritizing brokers with zero stock trading fees: it’s prudent to choose online brokerages that abstain from charging for stock purchases and sales;

- Seeking low minimum balance accounts: ensure the brokerage doesn’t mandate a substantial minimum balance; numerous platforms provide zero minimum balance options;

- Favoring brokerages that accommodate fractional shares: to enable investments as modest as $1 in prestigious companies with lofty stock values, selecting brokers that permit the acquisition of partial shares is crucial.

Youth-Centric Custodial Brokerage Accounts

The following online brokerages warrant exploration for adolescent investors:

- Charles Schwab (now inclusive of TD Ameritrade);

- E-Trade;

- Fidelity;

- Interactive Brokers;

- Ally Invest;

- Greenlightcard;

- Bloom;

- Stockpile;

- Stash;

- Acorns.

7. Avoid Investment Scams

Should anyone pledge returns far surpassing the annual gains attainable through stock market investments, it is prudent to exercise caution unless one possesses comprehensive knowledge or has a high tolerance for swift financial depletion. A maxim worth heeding is this: substantial profits in any investment inherently entail proportionally heightened risks.

Contrasting Promised Investment Yields with Market Returns

As an illustration, the stock market, over extended periods, typically garners an annual interest rate ranging from 7% to 9%, contingent on the time span under consideration.

Certainly, the stock market can yield exorbitant returns (provided one invests in an index fund that mirrors benchmarks like the Dow Jones or the S&P 500). For instance, an investment in an S&P 500 index fund in 2020 likely yielded a profit of approximately 16.3%. Yet, during the tumultuous year of 2008, a similar fund’s returns plunged to a staggering negative 38.5%. Thus, no one can pledge a consistent annual yield when entrusting your capital to the stock market.

Beware: Elevated Returns Equate to Elevated Risks

Individuals who assert they can prudently manage your funds and consistently secure an annual return, say, at 12%, through stock investments (or any other asset class, for that matter) are disingenuous concerning the inherent risks involved. We have encountered investment propositions that proffer sky-high interest rates for what can be described at best as highly speculative ventures, and at worst, outright frauds. Here is a roster of warning signals highlighted by the Securities & Exchange Commission, which investors should heed when evaluating an investment proposition:

- The proposition appears excessively enticing. In line with the adage, “If it sounds too good to be true, it probably is,” contrasting pledged returns or interest rates with the established benchmarks, such as the S&P 500 Industrial Average, is imperative. Any investment promising substantially superior returns compared to these widely available indices is, by definition, fraught with risk. Risk, however, is not inherently detrimental, as it often corresponds with the prospect of commensurate gains. Nevertheless, comprehending the extent of risk prior to investing is indispensable;

- An unusually high “guaranteed return.” Most malefactors expend considerable effort in persuading investors of the extraordinarily high “guaranteed” returns their investments purportedly offer. If an entity, whether an individual or a company lacking significant renown, asserts an abnormally elevated guaranteed profit, vigilance is warranted. Even when dealing with a familiar entity, an excessively lofty guaranteed return should arouse skepticism, as it may not account for the entirety of associated risks;

- Obscurity surrounding the entity. In cases where a company, broker, or adviser remains unfamiliar, diligent scrutiny is in order before committing to an investment. Most publicly traded companies file electronic disclosures with the Securities and Exchange Commission (SEC), accessible through www.sec.gov. Additionally, databases are available for researching brokers and advisers. It is worth noting that if a purportedly reputable financial entity provides only a post office box as an address, extensive due diligence is imperative. Furthermore, any mention of “penny stocks”—equities trading for less than $1—ought to trigger a hasty retreat;

- Coercion to invest “immediately.” Scammers frequently strive to cultivate a sense of urgency, fostering the impression that failure to act promptly will result in forfeiture of a remarkable opportunity. However, astute investors, particularly young investors, allocate time for meticulous research prior to committing capital. When confronted with pressure to invest, particularly in a “once-in-a-lifetime,” “too-good-to-be-true” proposition that one “cannot afford to miss,” a resolute refusal is the prudent course of action. Your financial well-being shall reap the rewards of such prudence;

- Complexity of the investment. Con artists frequently employ an array of grandiose terminology and technical jargon in a bid to dazzle prospective investors. It is paramount to maintain faith in one’s ability to discern the intricacies of an investment. If an agent fails to elucidate a concept with sufficient clarity, rendering it comprehensible, the onus should not fall upon the investor. To invest in such a product would be unwise.

The Pitfalls of Penny Stocks for Adolescent Investors

For young and juvenile investors, it would be prudent to steer clear of “penny stocks.” These equities represent shares of exceedingly diminutive enterprises that transact beneath the $5 threshold. Within the realm of penny stocks, a prevalent ploy perpetrated by fraudulent stock investment practitioners ensnares unsuspecting and guileless investors. It’s essential to clarify that the companies issuing these stocks may not inherently be problematic. The issue lies in the scarcity of publicly accessible documentation that could furnish investors with dependable insights regarding the financial well-being of these minuscule entities. This dearth of information creates an opportune environment for unscrupulous brokers and advisors to entice impressionable investors into acquiring these stocks.

Furthermore, the price of penny stocks is remarkably susceptible to manipulation, particularly through the machinations of “pump and dump” stratagems. In these deceptive schemes, investors extol the worth of their penny stocks holdings and subsequently divest themselves of these shares when their prices experience a transient surge, inevitably leaving nascent investors with assets of diminished value.

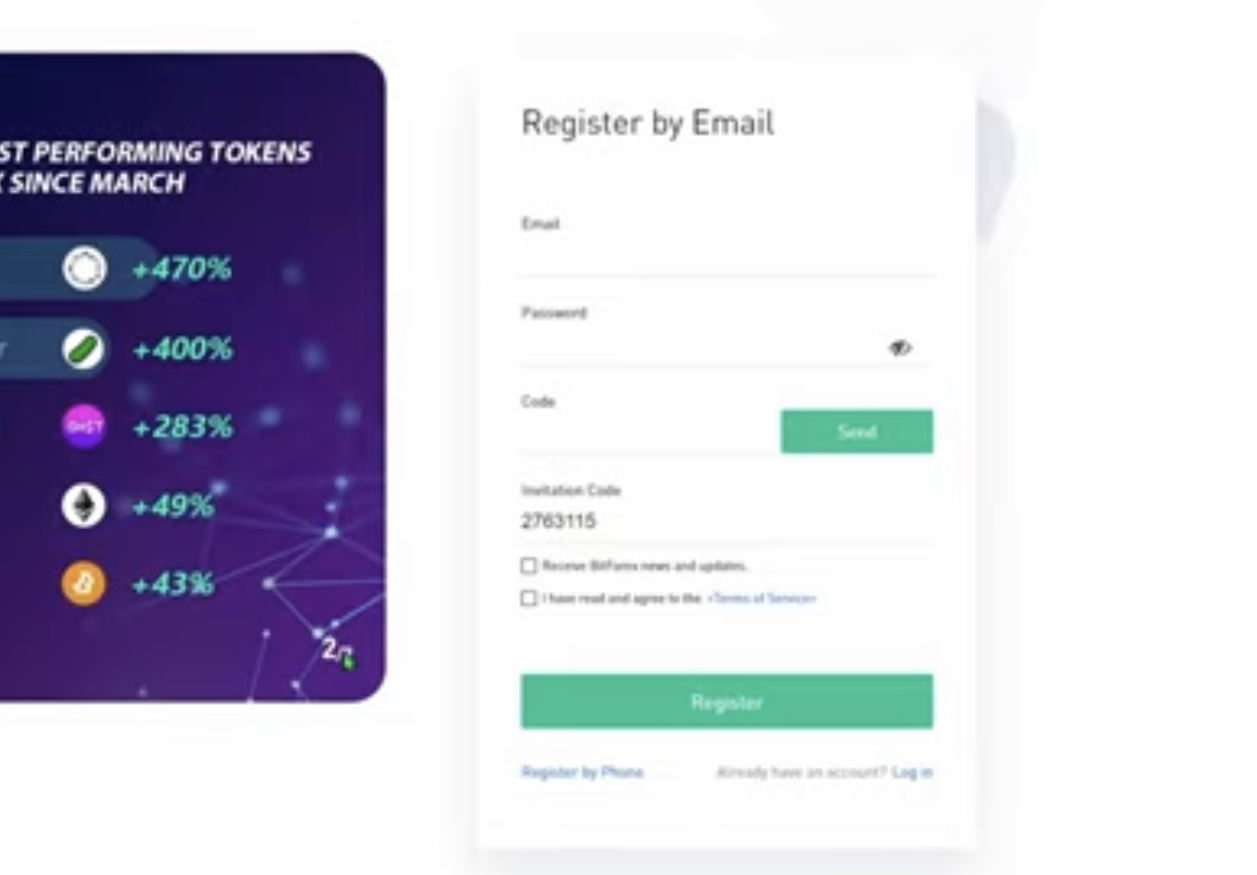

Cryptocurrency and Adolescent Investors

Before venturing into the realm of cryptocurrencies, we highly recommend perusing our comprehensive guide titled “Crypto for Teenagers,” which provides fundamental insights into cryptocurrency investments.

Cryptocurrency represents an investment avenue, whether in the form of traditional stocks or virtual currencies, that adolescents and youngsters should, for the time being, prudently eschew. The rationale is straightforward—the volatility characterizing the valuation of cryptocurrencies and cryptocurrency-related investments is exceedingly pronounced. Bitcoin, arguably the most renowned cryptocurrency, serves as a prime illustration, having undergone a precipitous depreciation over seven months. In November 2021, the valuation of a single bitcoin stood at approximately $68,000. Come June 2022, the value had plummeted to around $20,000—an astounding 70% decline.

Adding to the disconcerting narrative are prominent bankruptcy declarations from notable cryptocurrency lending platforms in 2022, including Celscius, Voyager Digital, and Three Arrows Capital. These insolvencies left myriad customers marooned with minimal prospects of reclaiming their cryptocurrency holdings. While investing in cryptocurrency may hold an allure of excitement, it’s imperative to acknowledge that, at present, it more closely resembles a venture into the world of gambling unless one possesses a profound understanding of the nuances involved. Aspiring investors may be wise to exercise patience before delving headlong into the intricate realm of cryptocurrency investments.

In conclusion

Embarking on your investment journey as a teenager can be a transformative experience. By following the steps outlined in this article, you’ve equipped yourself with the knowledge and tools needed to make informed decisions and grow your wealth over time. Remember that investing is a long-term endeavor, and patience is your ally.